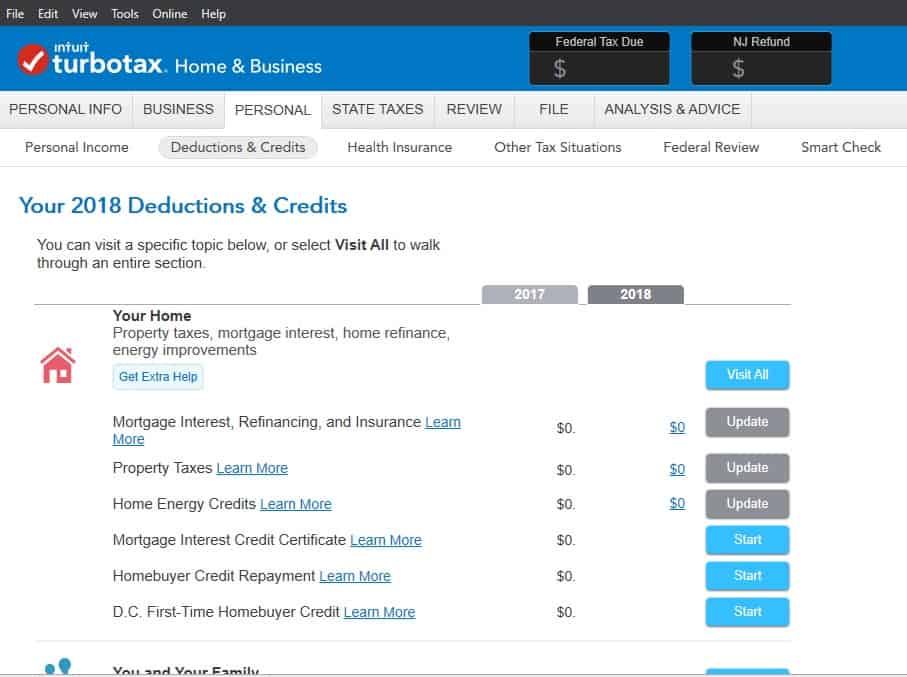

I make sure my spreadsheets are accurate and that I have paper copies (in case of an audit) organized and in one place. Day 2 (file your taxes) – I calculate all of my expenses and things I want to deduct.(This year, I put them in a file until I was ready to look through them.) I also go ahead and download any investment income, plus documents for my mortgage, and make sure I have health insurance verification. As they come in, I check them off the list. Day 1 (income and expenses) – I double-check how much I made and make a list of all the W-2’s and 1099’s I’m set to receive for the tax year.While this seems like a lot, trust me, it isn’t, and it will save a lot of headache and stress if you work little by little, over time, rather than trying to cram it all in at the last minute. The Turbo Tax step by step guide you’ll see below allocates tasks and to-do’s for each of these days over a three-week spread. I recommend breaking down the entire tax process into smaller one- to two-hour chunks over two or three weekends prior to the filing deadline of April 15.

Turbotax 2017 online free software#

In the article below, I provide a Turbo Tax step by step guide to filing taxes online with the TurboTax free software and cover some common questions many of you have about doing your taxes yourself and the online filing process.

While more of a hassle than say, returning a package, filing your income tax online doesn’t have to be overly complicated, if you plan properly and leverage great technology, such as TurboTax free filing online. Even if you don’t run your own business or have complicated taxes, filing online can be intimidating. Even though I cover personal finance topics for a living, tax season still sneaks up on me every year. INSIDE: Filing your taxes online doesn’t have to be overly complicated, especially with the TurboTax free version online.

0 kommentar(er)

0 kommentar(er)